Capital Market Services (FAQs)

1. What is Structured Finance?

Structured finance essentially is the process of making a loan based on a strong performance in cash flow in the past. Rather than other assets being used as collateral for the loan, funds are advanced based on the history that indicate a consistent flow of cash into the borrower’s business that will allow for the timely and orderly repayment of the loan amount.

The use of structured finance can be attractive to businesses that do not have many material assets, but have a strong client base and a history of monthly billing coupled with consistent debt collection. For businesses that are looking to expand their client base, and need some quick cash to do it, structured finance may represent the most cost efficient way to raise funds.

2. What is Corporate Finance / Loans?

Corporate loans are term loans which have a longer tenure as compared to business loans. These are tailor made loans tailored to your specific needs. Example: Customer can choose to pay his EMI by choosing the tenure. I.e. a customer has the flexibility of choosing the tenure and EMI.

3. What are Features and Benefits of Corporate Finance?

-

Best product for higher loan amount and for a longer-term

-

Suitable for business and can be used for working capital requirement

-

Cost-effective as compare to Business loans

-

The maximum term available is 10 years

-

Lowest EMI as larger tenure and low Rate of Interest

4. What is Equity Release?

Equity release is finance against your existing land or property, allowing you to invest in another home or fund another venture.

5. What is Mortgage Loan or Housing Loan?

Hosing Loan or a Mortgage Loan is a loan for buying a readymade home or building your own (under construction).

6. How to find the best deal on loan?

Finding the right mortgage loan to suit your needs can be a challenge, especially with so many different offers available.

This is where our experts can help. Our Loan comparison service covers the entire market, and, once you’ve answered a few simple questions, we can help search a better product as per your requirement. Our team will do all the leg work for you and get you the best possible deals to meet your home loan requirement.

7. I’ve been turned down by my bank before. Can I still get a Corporate Loan?

Yes. We have helped many businesses obtain a loan, even after they have been turned down by other banks.

8. What are the factors affecting the eligibility for Loan?

The main factors affecting the eligibility for Loan Against Property are as follows:

-

Income of all applicants

-

Active loans and liabilities

-

Age of the applicant

-

Property value

9. What is Qatar Credit Bureau?

Qatar Credit Bureau established by the decision of the Board of Directors of Qatar Central Bank (No.5) of the year 2008, issued on 29/6/2008, and it went live on 21/3/2011.

Qatar Credit Bureau, which works under the aegis of Qatar Central Bank, is one of the important means that provides credit information of individuals, institutions and commercial companies operating in Qatar.

HE Sheikh Abdullah Saud Al-Thani, Governor of Qatar Central Bank, highlighted the importance of the role of Qatar Credit Bureau by explaining: "The management of the Qatar Central Bank considers the importance of establishing Qatar Credit Bureau to contribute in the grounding of sound credit policies, that will assist in taking the right credit decision and to reduce the financing risks, which will reflect positively on the financial stability of the State of Qatar”.

10. What is Credit Report?

Qatar Credit Bureau provides credit reports to individuals, corporations and member institutions of Qatar Credit Bureau upon their request. You can get your credit report by visiting Qatar Credit Bureau customer service, the report shows the credit information of customer who obtained credit facilities from any facility providers during a specified period, and contains a summary of the credit position of the customer and the dishonoured cheques.

For your Credit report, click below

11. What is Credit Score?

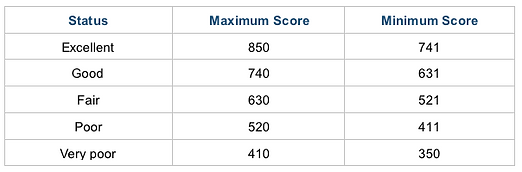

Credit scoring is a scoring system that converts the information contained in a credit bureau consumer profile into a numeric score, ranging from 350-850. This score is predictive of all future credit performance and is used to rank-order consumers based on the future credit risk (higher scores presenting lower risk).

12. The following table illustrates the credit scoring marks:

13. Factors Affecting the Credit Score:

-

Increased number of unsecured loans

-

Making frequent loan enquiries will reflect in one's credit report. If there are too many enquiries in a short span the credit score will decline proportionately.

-

Delayed payment of loan instalments and credit card dues will decline the credit score. It is always better to make funds available prior to the due dates of payments to ensure the dues are promptly paid.

-

Credit cards used judiciously and payments made within the stipulated period will keep the credit score healthy. Avoid utilisation of full limit of a credit card.

14. Reasons for Rejection of the Loan Proposal:

Having a good credit score, good income, and good repayment capacity may not be an assurance for getting the loan approval. Despite this there are factors that could affect the credit decision. They are:

-

Negative remarks in the credit report may influence the credit decision of the lender. These remarks imply that the applicant has gone through some financial crisis at some point due to which they were not able to make the loan repayment. Lenders will get sceptical about the applicant's skill of managing finance. They may wonder what if the same situation arises once again. Then it may become difficult to recover the loan amount. At no point lenders would want to add a high-risk asset to their basket.

-

Lending institutions maintain a record of address and identity details of all defaulting borrowers. If one is sharing accommodation with other inmates and one of the inmates has defaulted in loan repayments, then another application having the same address will not be considered favourably. Lending institutions match the address of any new application with the address of defaulters before making a credit decision.

-

If someone for whom one has stood as a guarantor has defaulted in the loan repayments then the loan proposal may be rejected since the same will be reflecting in the credit report.

-

There is a ratio fixed by lending institutions to ascertain that the net take home salary is enough for sustenance after providing for all the commitments including the proposed EMI. Normally the ratio called loan to EMI ratio is fixed between 40% to 60%. This differs from institution to institution. If the applicant does not fit into this ratio then the loan proposal will be rejected.

Impulsiveness in borrowing should not be revealed in the credit report. If a borrower has frequented too many institutions in quest of loan which is seen in the credit report, then the proposal may not be considered favourably.

15. How can I calculate my Equated Monthly Instalments (EMI)?

16. How much can I borrow?

The Loan amount will be based on the following factor, which varies for the property type and current usage of the property.

-

Residential, Commercial or Industrial Property – 60% of market value

-

Land – 50% of market value

-

Financing up to 80% of the value of equipment and machinery (excluding buildings)

17. How much is loan processing fees?

The processing fee for the loan against property varies from bank to bank and most of the banks charges 1% to 2% of the loan amount.

18. What’s the maximum loan tenure?

Loan tenure is from 180 to 240 months for Qatari nationals and Expats for Housing Loan and 84 months to 120 months for Qatari nationals and Expats for Corporate Loan.

19. What Credit Score is good for Loan Approval?

Nowadays, your credit score plays a vital role in your loan eligibility assessment. Banks do review individual credit report before sanctioning of any type of loan. There are banks that offer some discount to customers having a high credit score. One must have a credit score of 631 and above with a clear repayment track record of all existing loans.

20. How can I shift Loan against property to another bank at low rates?

Any loan can be shifted from one bank to another to avail better rate of interest and other benefits. Our team will help you with a detailed comparative analysis of balance transfer offers to reduce your interest rate and EMI.

21. Which properties can be offered as collateral or security for Corporate Loan or Equity Release or Loan Against Property (LAP)?

The following properties can be offered as collateral or security for Corporate Loan or Equity Release or Loan Against Property. We accept both lease hold as well as freehold properties:

-

Self-occupied Residential – Villa Compound, Villa, Lowrise, Midrise, Tower, Service Apartments

-

Self-occupied Commercial - Lowrise, Midrise, Tower

-

Industrial - Old Industrial, New Industrial, Mesaieed, Warehouse

-

Retail – Shops, Souq, Malls

-

Hospitality - Hotels, Hotel Apartment, Resorts

-

Schools & Educational Institutes

-

Land – Vacant Plot

-

Agricultural Properties – Farm Land

-

Mixed use land and Building

22. Do you want to hold your property plans due to the Coronavirus?

While buying a new home is an emotional decision, it can also be very time taking. With the current coronavirus health pandemic added to the mix, it may have caused you to rethink your property plans.

For those who have been looking to make their move into the property market we encourage you not to lose hope. One thing we are certain of – the coronavirus pandemic will eventually pass and we are here to help you stay on track with your property goals.

23. Where can I apply for loan?

Meet our Relationship Manager, he will help you from loan application till the complete process. We are dealing with all major banks in Qatar.

24. What are the documents required for a loan?

For self employed

Signed and completed application form

Business profile

Credit report (if available)

Copy of Qatari ID card

Copy of passport with valid Visa (for Expatriates)

Commercial Registration and trade license

Articles of association / company contract (Memorandum of Incorporation)

Sanction letter / facility letter bearing terms and conditions of all running loans

Audited financial statements for last 2 years

Last 12 months business bank statements of all accounts

Last 6 months personal bank statements of all accounts

Copy of title deed of the property

Rental contract from Government or Private (if rental income is being considered)

Net-worth statement

For Salaried

Signed and completed application form

Copy of Qatari ID card

Copy of passport with valid Visa (for Expatriates)

Salary certificate/salary assignment letter from your employer

Last 6 months personal bank statements of all accounts

Copy of title deed of the property

25. What is the minimum and maximum age required to apply for a loan?

Qatari National 18 yrs (min) 70 yrs at maturity of the loan

Expatriates 21 yrs (min) 60 yrs at maturity of the loan

Criteria may change slightly from bank to bank.

26. What is the maximum loan amount I can avail?

Amount to the extent of 60% of market value of the property is available as Loan subject to income qualification. Where as in case of Housing Loan, banks offer 70% of market value of the property.

27. How long will it take to get my loan approved?

-

Meet our Relationship Manager

-

Provide all the documents.

-

Receive verbal approval within 10 to 20 working days.

28. Do all owners of the property have to be co-borrowers to the loan?

Yes, it’s mandatory that all owners should be co-borrowers.

29. Do you require insurance?

Yes, both life insurance and property insurance are mandatory. The property insurance premium is calculated on the cost of the property.

30. How is my mortgage loan application evaluated?

Your application will be evaluated on the following criteria:

-

Your income stream

-

Stability of your company

-

Your ability to handle current obligations as well as new ones and your credit history (credit bureau report)

-

The value of the property being offered as security

31. What are Rental Income Loans?

Rental loans is one of the unique product which is designed to the Qatari customers who are interested to avail a loan facility against the rental they received from their rented properties.

32. How to calculate Interest?

Commencing from the Loan Date, interest shall accrue on the Loan on a daily basis at the relevant Interest Rate and will be capitalized to the Loan Amount at the end of each month.

Interest will be calculated as per following formulae:

The Daily Balance of the Loan X Total Annual Rate X (1/360)

33. Why YOU should use our services?

-

We will help you to secure the tailor made loans at competitive interest rates

-

We will facilitate best and the most affordable financial products

-

We make sure that the bank understands your product and its risks

-

Faster approvals and disbursement

-

Regular update on your loan status