Corporate Loan Basics

1. What is Corporate Finance / Loan?

Corporate loan is a term loan which has a longer tenure. These are customized loans tailored to your specific needs. Example: Customer has the flexibility of choosing the tenure and hence, the installments.

2. What are the factors affecting the eligibility for Loan?

The main factors affecting the eligibility for Corporate Loan are as follow:

· Income of the company

· Active loans and liabilities of the company

· Stability of your company

· Market value of the property offered as the collateral

· Ability to handle current obligations as well as new ones and your credit history

3. What is Credit Score?

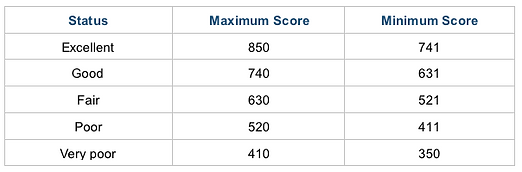

Credit scoring is a scoring system that converts the information contained in a credit bureau consumer profile into a numeric score, ranging from 350-850. This score is predictive of all future credit performance and is used to rank-order consumers based on the future credit risk (higher scores presenting lower risk).

The following table illustrates the credit scoring marks:

4. How much is loan processing fees?

The processing fee for a corporate loan varies from 1% to 2% of the loan amount.

5. What is the minimum and maximum loan tenure?

Loan tenure can be 84 months to 120 months for Qatari nationals and Expats for Corporate Loan.

6. What is the minimum and maximum age required to apply for a loan?

Qatari National 18 yrs (min) 70 yrs at maturity of the loan

Expatriates 21 yrs (min) 60 yrs at maturity of the loan

7. What are the documents required for a corporate loan?

· Company profile

· Recent and valid Commercial Registration

· ID/CR copies of partners/owners and authorized signatories

· Audited financial statements for last 2 years

· Account statements for the last 6 months

· Copy of title deed of the property

8. Do all owners of the property have to be co-borrowers to the loan?

Yes, all owners must be co-borrowers.

Note: Criteria may change slightly from bank to bank.

To learn further details on the Corporate Finance / Loan